Closing Costs in MN: How Much to Expect?

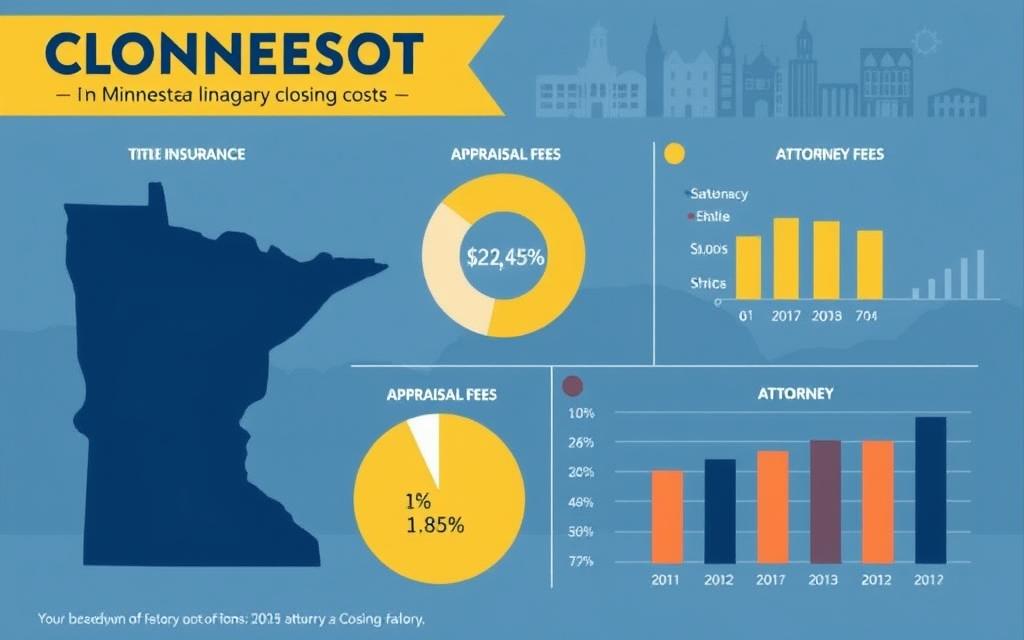

Did you know that the average closing costs for home buyers in Minnesota are about $4,011? This is much lower than the national average of 1.81%. Knowing how much closing costs are in MN is key for anyone buying or selling a home. These costs include various fees that can greatly affect your budget.

Buyers in Minnesota usually pay between 2% and 5% of the home’s price in closing costs. Sellers pay around 8% to 10% of the home’s sale price. Understanding these costs helps me prepare for the financial commitment of buying a home. Having a good estimate of closing costs in MN is vital to stay within my budget and make smart decisions.

Key Takeaways

- The average buyer closing costs in MN total around $4,011.

- Typical buyer costs range from 2% to 5% of the purchase price.

- Sellers face costs that are approximately 8% to 10% of the home’s selling price.

- Real estate commissions generally fall between 5% to 6% of the sale agreement.

- Understanding closing costs can help in budgeting for home transactions.

Understanding Closing Costs in Minnesota

Closing costs are the expenses needed to complete a real estate deal. They affect both buyers and sellers in Minnesota. The costs for buyers can be between 2% and 7% of the home’s price.

For example, with a median home price of about $340,000 in September 2021, buyers might pay between $6,800 and $23,800. These costs vary based on the deal’s specifics.

Sellers also have significant closing costs, often higher than buyers. These can be 6% to 10% of the home’s sale price. So, for a $340,000 home, sellers might pay between $20,400 and $34,000. Sellers usually cover agent commissions and other fees for transferring ownership.

Knowing these costs helps when negotiating deals. In Minnesota, sellers don’t have to pay buyer’s closing costs. But, they often agree to help with some costs. Looking at my closing statement showed how important it is to be ready for these costs.

Being aware of closing costs can make buying or selling a home less stressful. It helps understand the process better.

How Much Are Closing Costs in MN?

When buying a home in Minnesota, it’s key to know the costs. Closing costs are a big part of the process. They cover fees needed to complete the deal.

Average Closing Costs Breakdown

Closing costs in Minnesota usually are about 3% of the home’s price. This can change based on where the home is and the lender’s rules. For example, in the Twin Cities, costs can be close to 3% of the selling price.

Expenses include lawyer fees, appraisal costs, and fees for getting the mortgage. Keeping track of these helps me plan my budget better.

Factors Influencing Closing Costs

Many things can change closing costs in Minnesota. The home’s price is a big factor. So are the lender’s fees and other costs like property taxes.

My credit score also matters, as it affects the mortgage terms and costs. Different lenders offer different down payment options. This can help lower the costs. Understanding these factors helps me get a clear picture of what to expect.

Who Pays Closing Costs in Minnesota?

Knowing who pays what in the closing process is key for anyone buying a home in Minnesota. Usually, the buyer pays most of the closing costs for buying a house in minnesota. The seller also pays their share. This affects your budget and the deal’s success.

Buyers vs. Sellers Responsibility

As a buyer, you’ll face several costs when buying a home. Loan origination fees are a big one, costing 0.5% to 1% of the loan. You’ll also pay for appraisal fees, title insurance, and other property costs. These can add up to 3% to 4% of the home’s price.

The mn closing costs for seller include realtor commissions, legal fees, and deed taxes. These costs usually total 1% to 3% of the sale price. Asking the seller to cover some costs can ease your financial burden.

It’s important for both sellers and buyers to know their costs. Clearing up financial responsibilities helps the closing go smoothly. For more info, check out closing costs in Minnesota.

Typical Closing Costs for Buyers

Buying a home in Minnesota means knowing about closing costs. These can be 2% to 5% of the home’s price. Understanding these costs helps me budget and avoid surprises.

Loan-Related Fees

Loan-related costs are a big part of closing costs. The lender might charge an origination fee, from 0.5% to 1% of the loan. There’s also a credit report fee, usually $30.

Appraisal fees, which check the home’s value, can be $300 to $400. If I put down less than 20%, I’ll need to pay for Private Mortgage Insurance (PMI). This adds to my costs.

Property-Related Expenses

There are also property-related costs to think about. Recording fees, which vary from $25 to $250, are one of them. Escrow fees and attorney fees might also apply.

On average, closing costs are around $3,279. Knowing these costs helps me budget better. I can also try to negotiate fees, like seller concessions, to lower my costs.

Typical Closing Costs for Sellers

Selling a home in Minnesota comes with its own set of expenses. As a seller, knowing the typical closing costs is key to managing your money well. These costs usually range from 6.25% to 9% of the sale price. It’s important to understand the parts that make up mn closing costs for seller.

Major Seller Fees Explained

The real estate commission is a big expense, usually between 5% and 6% of the sale price. For a home worth $330,700, this commission could be up to $29,763. You might also have to pay for a title search, which costs between $40 and $250. Plus, there’s the realty transfer tax, which is 0.33% for homes sold over $3,000.

Property taxes, HOA fees, escrow fees, and other costs can add up. Knowing about closing costs real estate mn helps make the closing process smoother.

Negotiating Seller Costs

You can often negotiate some seller costs. Talking about these fees can save you a lot of money. Consider using a Flat Fee MLS listing service, like Houzeo, to cut down on commission costs.

Negotiating on title insurance, escrow fees, and even real estate commission can also reduce costs. Knowing about these fees helps you negotiate better.

Regional Variations in Closing Costs

Exploring closing costs in Minnesota shows big differences. Urban areas, like the Twin Cities, have higher costs due to demand and property values. Fees such as real estate agent commissions can add about 6% to the sale price. This increases the total cost for both buyers and sellers.

Rural areas have lower closing costs. This is because of the market conditions and lower property values. Sellers in these areas might pay between 1% to 4% of the sale price. This is much less than what urban areas charge.

The real estate market in Minnesota changes, offering chances to negotiate. Negotiating at the closing table can help sellers reduce their fees or pass some costs to the buyer. Knowing these regional differences helps me deal with closing costs better.

Companies like Minnesota Home Guys can help sellers avoid closing costs. This makes the process cheaper and easier. Getting advice on tax implications of closing costs helps me understand the benefits when selling or buying a property.

Calculating Your Closing Costs

Understanding closing costs is key for anyone in a real estate deal in Minnesota. Knowing the costs helps avoid surprises and plan your budget better.

Using a Minnesota Closing Costs Calculator

An important tool for buyers and sellers is the Minnesota closing costs calculator. It gives a detailed look at costs based on the property’s price and other factors. For example, closing costs usually range from 2% to 5% of the home’s value.

On a $150,000 property, that’s $3,000 to $7,500 in costs. The calculator lets you input loan amount and property details for a personalized estimate.

Knowing about costs like title insurance and government fees is crucial for planning. The Minnesota closing costs calculator helps you prepare and make smart financial choices during the buying or selling process.

How to Lower Your Closing Costs in Minnesota

Managing closing costs in MN can be easier than you think. One effective strategy is to ask the seller to cover some of your costs. This can greatly reduce the cash you need at closing. Also, closing at the end of the month can save you money on interest.

Negotiating Seller Concessions

Negotiating with sellers is a smart move in today’s market. It can cut down your out-of-pocket expenses. Discussing fees like title insurance and closing costs during the agreement phase is key. This not only saves you money but also makes your offer more attractive.

Shopping for Better Loan Offers

Shopping around for loans is another great strategy. By comparing rates and terms, you can find a mortgage that fits your budget. The Loan Origination Fee and other costs can vary a lot. Taking the time to shop around can lead to better deals and lower costs.

FAQ

How much are closing costs in MN?

Closing costs in Minnesota can be less than 1% or more than 5% of a home’s price. The average is about 1.4%. For a home priced at around 9,650, you might pay about ,895 in closing costs.

What are the average closing costs in Minnesota?

The average closing costs in Minnesota are about 1.4% of the home’s sale price. This amount can change based on where you are and the lender’s fees.

What is included in the closing costs breakdown in MN?

Closing costs include fees for the loan, title insurance, property taxes, and realtor commissions. Sellers usually pay for realtor commissions and deed taxes. Buyers handle loan fees and property-related costs.

How can I estimate closing costs in MN?

You can use a Minnesota closing costs calculator. It gives you an estimate based on the home’s price and other factors that might affect your costs.

Who is responsible for closing costs in Minnesota?

Buyers and sellers each have their own costs. Buyers pay for loan fees and property costs. Sellers cover realtor commissions and deed taxes.

What typical closing costs do buyers face in Minnesota?

Buyers face costs like origination fees and appraisal costs. They also pay for property inspections and title insurance. These can total 2% to 5% of the home’s price.

What closing costs should sellers expect in Minnesota?

Sellers usually pay for real estate commissions, which are 5% to 6% of the sale price. They might also pay for title searches and deed taxes.

Are there regional variations in closing costs in Minnesota?

Yes, closing costs vary by location. The Twin Cities have higher costs due to demand and property values. Rural areas have lower costs.

How can I lower my closing costs in Minnesota?

To lower costs, buyers can ask sellers to help with expenses. Both parties can also look for better loan deals.